Confidence se bhara har pal. Jaisa aaj, waisa kal

When it comes to planning for retirement, having confidence in our financial decisions is key. Each choice we make now, like planning and investing wisely, shapes how comfortable we'll be when we retire. It's about being sure that our actions today will determine a happy and secure future when we're not working anymore.

More and more people are securing their retirement by opting for National Pension System (NPS)

1,665,120

Industry AUM (In Crores)

5,460

Tata Pension Fund AUM (In Crores)

91,309

Tata Pension Fund Subscribers

AUM as on : Jan 9, 2026

Don’t let the fun stop!

Why do you need a retirement plan?

Being financially independent is great, isn’t it? But an unprepared retirement can take that away.

Sustained lifestyle

Let’s face it, retirement calls for a major dip in the lifestyle. This happens when the steady, monthly income stops flowing.

Inflated expenses

While the overall inflation is 6%, some daily products like medicines, food and groceries, transport continue to be more and more expensive by the year at higher rates. The future rate of inflation is projected to be even higher.

Healthy living

By providing a steady stream of income throughout your retirement, NPS helps alleviate financial stress, giving you peace of mind and the freedom to focus on healthy habits and hobbies.

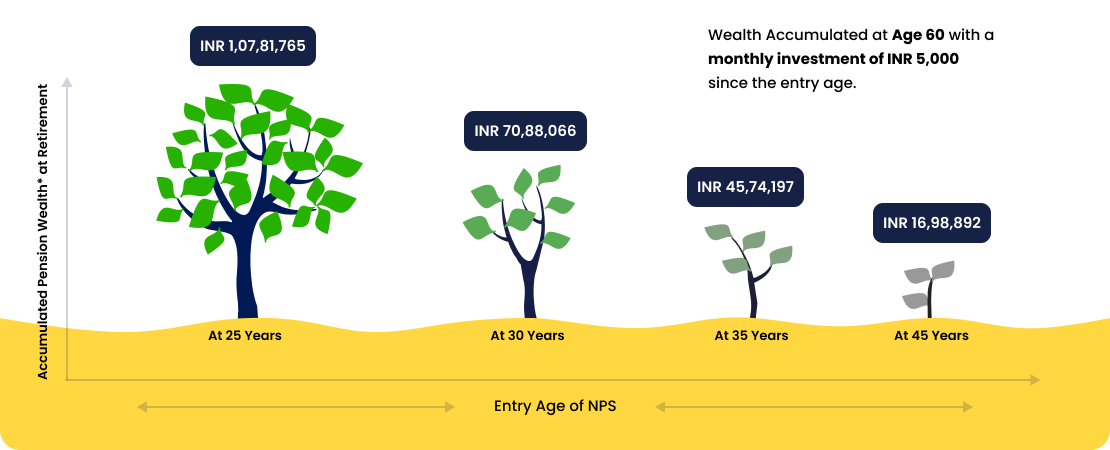

When should you start planning your retirement?

The answer is always ‘Now!’

It's never too early to start planning for retirement, but the ideal time to begin is as soon as possible. Starting retirement planning early in one's career is ideal, as it allows for the benefits of compounding to maximize savings over time. However, regardless of career stage, the best time to start planning for retirement is NOW.

The philosophy of pension

A little perspective can go a long way.

No Pension Plan Syndrome

Are you suffering from NPPS?

No Pension Plan Syndrome can cause dependency on loved ones, missing parties and shying away from new experiences due to lack of funds post-retirement. Are you likely to have this condition?

What is NPS?

A pension plan that gives you the freedom of an unretired life.

Sponsored by the GOI, NPS (National Pension Scheme) is open for all Indian citizens. It is governed by the Pension Fund Regulatory & Development Authority.

Sponsored by the GOI, NPS (National Pension Scheme) is open for all Indian citizens. It is governed by the Pension Fund Regulatory & Development Authority.

Tax benefits

Planning tomorrow is rewarding today. Get tax benefits up to 9.5 lakhs annually.

Financial Discipline

Securing your own future is a great motivator. It develops the habit of investing and helps you stay disciplined with your finances.

Trust us. We’ve been around for a while.

Our legacy is our asset. Its benefits are for you.

150

years and going strong!

That’s how long Tata has been contributing to the development of India. We have introduced several financial firsts in the country. And that’s how we have always been a part of India’s future story. It’s now time for us to partner with you, as you write your future.

31

years in investment management

Tata Asset Management Private Limited (TAM) has a track record of over 31 years in investment management. Being a Tata group company, we are known for our highest standards of ethics and fairness in all our business dealings.

Myths belong to bed time stories. Not your finances.

Busting popular beliefs

It's a common misconception that retirement planning is only for older individuals, but the truth is that starting early can greatly benefit your financial future. The power of compounding means that even small contributions to retirement savings in your younger years can grow significantly over time. By starting to save for retirement early, you give your money more time to grow, potentially allowing you to accumulate a larger nest egg by the time you retire. Additionally, starting early provides more flexibility and allows you to weather market fluctuations and unforeseen circumstances more effectively. Ultimately, the earlier you start planning for retirement, the better positioned you'll be to achieve your financial goals and enjoy a comfortable retirement in the future.

While it's true that some employers offer pension plans, it's important to understand that relying solely on your employer for retirement savings may not provide enough financial security.

Children may have their own lives to care for. Besides, a dignified living comes with being financially independent.

Health insurance comes with its limitations. Cover your retirement with NPS.

Don’t let your retirement be on the back burner. Your retired life is important too. Plan for it early.

PPF is not the best but one of the better options available for retirement planning. However, PPF has its limitations with regards to tax deductions up to 1.5L only while NPS provides higher tax benefits if combined with Sec. 80 CCD(1) and (2). Also, NPS provides the potential to earn better returns over the long term.

Don’t fall for these myths. Start NPS.

Speak to the experts - us

We understand that you might need a walkthrough and guidance to understand NPS. Speak to our counselors for the right advice and best solutions.